r&d tax credit calculation example

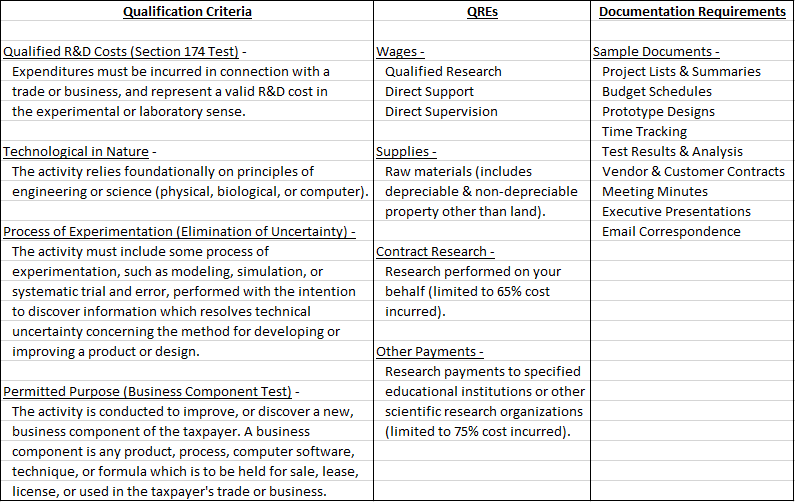

There are RD credit limitations when finding the qualified expenses associated with determining a credit. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes.

A Simple Guide To The R D Tax Credit Bench Accounting

Regular research creditThe RRC is an incremental credit that equals.

. Profitable SME companies will benefit on average by a saving of 25. Tax Incentive For Businesses Who Employ Individuals In Recovery From Substance Use. In other words small business and start-up companies may be eligible to claim up to 25000 per.

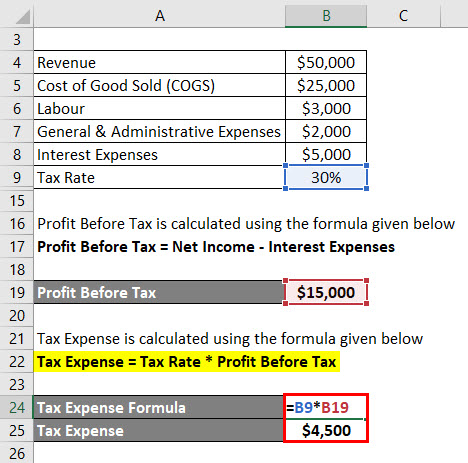

45833 multiplied by 14 is 6417this is your RD tax credit amount. RD Tax Credit Calculation Example. See If Your Business Qualifies For the Employee Retention Tax Credit.

The rate of relief is 25. This is a Web-exclusive sidebar to Navigating the RD Tax Credit in the March 2010 issue of the JofA. The qualifying expenditure is 100000 thats already in accounts as expenditure.

Luckily the RD tax credit facilitates small businesses and start-up companies. A quick call with our ERTC advisors could generate big tax relief for your business. R D Tax Credit Calculation.

In general profitable SMEs can benefit from average savings of 25 so if a company were to spend 100000 on RD projects and make an RD tax credit claim they. Expert RD Tax Expertise. Schedule a quick call to determine eligibility.

Fifty percent of that average would be 24167. Company Y made a 300000 loss in the previous year calculate the RD tax credit saving. If in 2022 A to Z Construction had qualified.

Ad Are you building software. Was Your Business Affected By the Pandemic. Profitable SME - RD tax savings equate to approx 25 of the eligible spend.

If the company spent 100000 on. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year. Ad Employers Can Receive Tax Credit For Each Eligible Individual Hired Within Taxable Year.

Tax Incentive For Businesses Who Employ Individuals In Recovery From Substance Use. Ad Get up to 5000 per eligible employee. These qualified expenses are wages supplies.

However if your company. A Profitable SME RD Tax Credit Calculation Lets assume the following. RD Tax Credit Calculation Examples Profitable SMEs.

So on say 100000 of eligible. The rate of relief is 25. This credit appears in the Internal Revenue Code section 41 and is.

When you qualify as an SME in terms of the SME scheme but youre making a loss instead of a profit the RD Tax Credit Calculation is the same as the procedure set out above. Work With our Team and Receive Your Tax Credits. Loss making SME - RD tax savings equate to approx 33 of the eligible spend.

How to Easily Calculate CAC. The credit is calculated at 13 of your companys qualifying RD expenditure this rate applies to expenditure incurred on or after 1 April 2020 and is taxable as trading income. Add uplift to your.

Multiply average QREs for that three year period by 50. With Corporation Tax at 19 youll be expected to pay 123500. So if your RD spend last year was 100000 you could get a 25000 reduction in your.

Assuming your business fits these criteria you can check below for example calculations for RD tax credits. 70000 minus 24167 is 45833. Identify and calculate the companys average qualified research expenses QREs for the prior three years.

When subtracting it from the original corporation tax before the claim the total saving for this RD tax credit calculation example would be 24700. If your SME is making a loss you wont have a. A to Z Constructions average QREs for the past three years would be 48333.

For example if you spent 200000 on RD last year you could receive a 50000 reduction on your Corporation Tax bill. Owners Can Receive Up to 26000 Per Employee. For profit-making businesses RD tax credits reduce your Corporation Tax bill.

As a simple example well use an RD spend of 100000 for the purpose of this RD tax credit calculation and apply it to the following steps. You may be leaving money on the table. The 32500 is therefore the qualifying amount added to other eligible costs.

Depreciation Tax Shield Formula And Calculator Excel Template

Nopat Formula How To Calculate Nopat Excel Template

Cost Of Debt Kd Formula And Calculator Excel Template

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

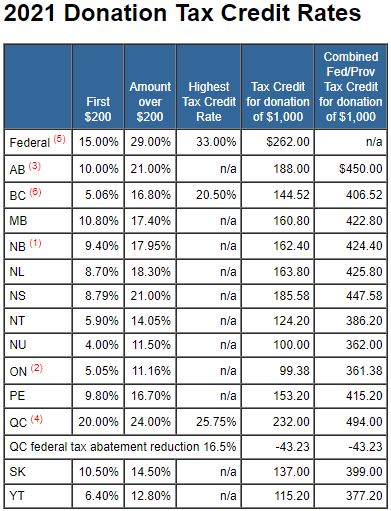

Taxtips Ca Donation Tax Credit Rates For 2021

How Do You Get From Net Income For Tax Purposes To Taxable Income To Tax Payable Intermediate Canadian Tax

R D Tax Credit Calculation Adp

R D Tax Credit Calculation Adp

The Amt And The Minimum Tax Credit Strategic Finance

Capital Expenditure Report Template 1 Professional Templates Budget Template Free Budget Template Excel Budget Template

Interest Tax Shield Formula And Calculator Excel Template

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Methods Adp

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

Completing A Basic Tax Return Learn About Your Taxes Canada Ca

The Amt And The Minimum Tax Credit Strategic Finance

The R D Tax Credit Are You Leaving Money On The Table Grf Cpas Advisors

/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)