ri tax rate income

Instead if your taxable income is less than 100000 use the Rhode Island Tax Table located on pages T-2 through T-7. Rhode Island Income Tax.

2022 State Income Tax Rankings Tax Foundation

Rhode Island State Personal Income Tax Rates and Thresholds.

. Rhode Island state property tax rate. Guide to tax break on pension401kannuity income. However the state changed its tax rules significantly in 2011 and these sweeping changes.

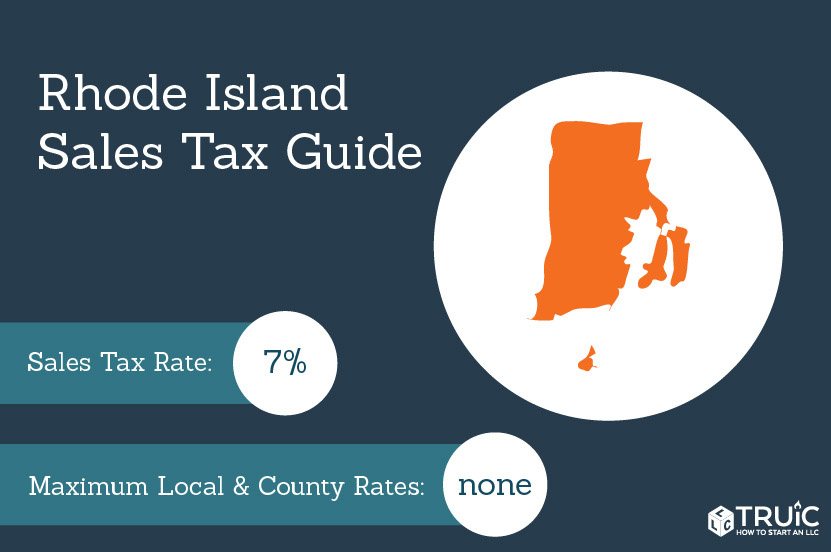

Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Your 2021 Tax Bracket to See Whats Been Adjusted.

Rhode Island state sales tax rate. 2021 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. This income tax calculator can help estimate your average income tax rate and your salary after tax.

The highest state income tax rate was 99. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of. The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax.

Any income over 150550 would be taxes at the highest rate of 599. Now that were done with federal income taxes lets tackle Rhode Island state taxes. We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island.

Until 2011 Rhode Island residents paid relatively high income taxes. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. This page has the latest Rhode.

As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. How many income tax brackets are there in Rhode Island. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

Subscribe for tax news. The first 66200 of Rhode Island taxable income is taxed at 375. Residents of Rhode Island are also subject to federal income tax rates and.

The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021. Rhode Island State Personal Income Tax Rates and Thresholds. 65250 148350 CAUTION.

One Capitol Hill Providence RI 02908. Rhode Island Division of Taxation. 2022 Rhode Island Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Taxable income between 66200 and 150550 is taxed at 475 and taxable income higher than that amount is. The state income tax rate in Rhode Island is progressive and ranges from 375 to 599 while federal income tax rates range from 10 to 37 depending on your income. There are three tax brackets and they are the same for all taxpayers regardless of filing status.

Directions Google Maps. DO NOT use to figure your Rhode Island tax. The tax breakdown can be found on the Rhode Island Department of.

If your taxable income is larger than 100000 use the Rhode Island Tax Computation Worksheet located on page T-1. DO NOT use to. 3 rows Rhode Islands 2022 income tax ranges from 375 to 599.

The first step towards understanding Rhode Islands tax code is knowing the basics. TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 64050 145600 But not over Pay--of the amount over 240188 627550 375 475 599 on excess 0 64050 145600. Ad Compare Your 2022 Tax Bracket vs.

The current tax forms and tables should be consulted for the current rate. Rhode Islands tax system ranks 40th. More about the Rhode Island Tax Tables.

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Rhode Island taxes most retirement income at rates ranging from 375 to 599. The state income tax system in Rhode Island.

Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. The rates range from 375 to 599. Rhode Island state income tax rate.

Levels of taxable income. Of the on amount Over But Not Over Pay Excess over 0 66200. RHODE ISLAND TAX RATE SCHEDULE 2020 TAX RATES APPLICABLE TO ALL FILING STATUS TYPES Taxable Income line 7 Over 0 65250 148350 But not over Pay--of the amount over 375 475 599 on excess 0 65250 148350.

This form is for income earned in tax year 2021 with tax returns due in April 2022. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. The Rhode Island Tax Rate Schedule is shown so you can see the tax rate that applies to all levels of taxable income.

It is one of the few states to tax Social Security retirement benefits though. The Rhode Island tax is based on federal adjusted gross income subject to modification. 3 rows Rhode Island state income tax rate table for the 2020 - 2021 filing season has three.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. 64050 145600 CAUTION. Every business corporation joint stock company or association exercising corporation functions or otherwise doing business in this state is required to file an annual tax return using Form RI-1120C and is subject to the income tax minimum 40000 under RI.

The income tax is progressive tax with rates ranging from 375 up to 599. Tax Filing Requirements. Rhode Island also has a 700 percent corporate income tax rate.

Discover Helpful Information and Resources on Taxes From AARP.

How Do State And Local Sales Taxes Work Tax Policy Center

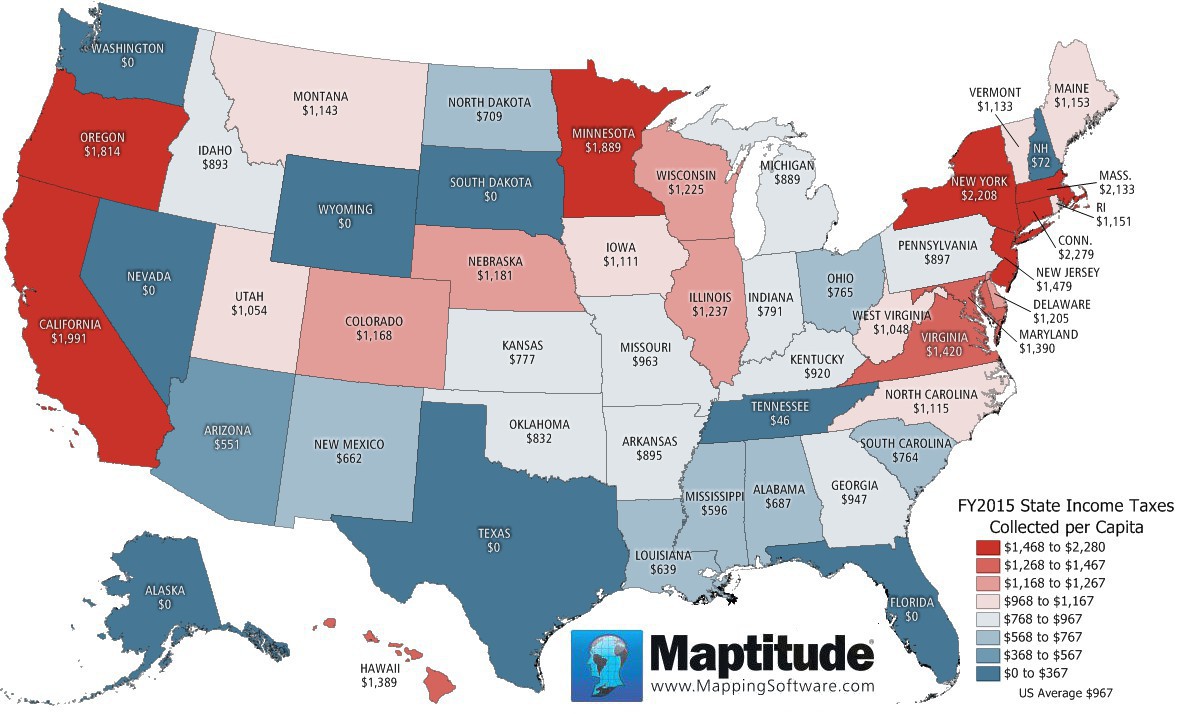

Maptitude Map Per Capita State Income Taxes

Rhode Island Income Tax Calculator Smartasset

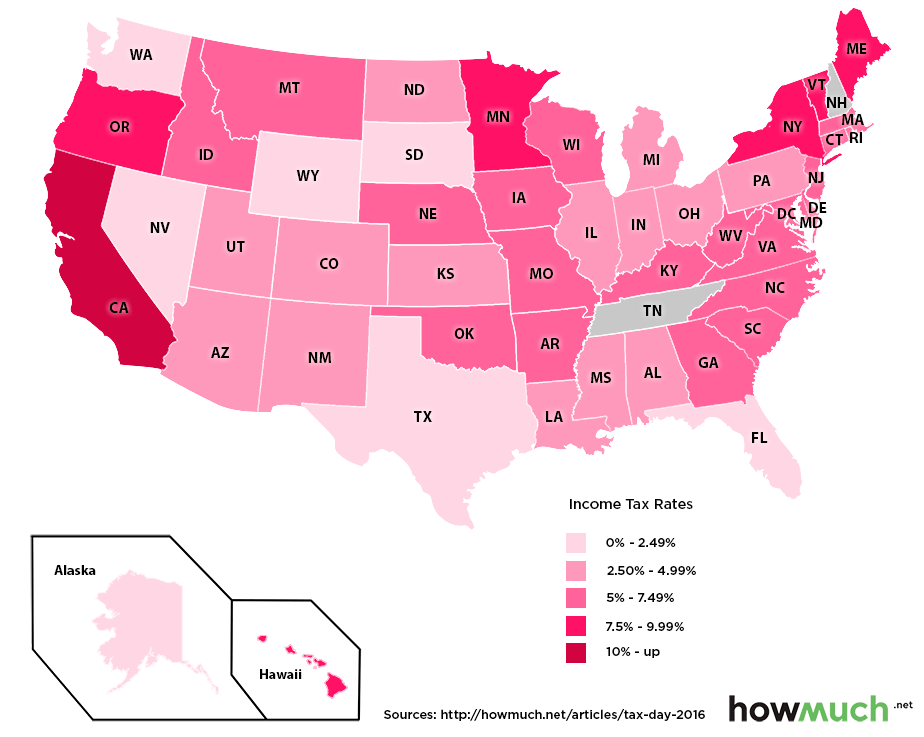

Which U S States Have The Lowest Income Taxes

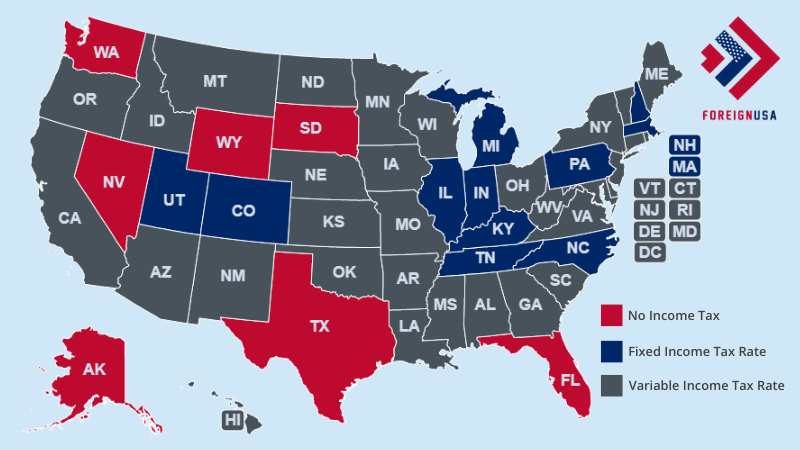

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Rhode Island Tax Forms And Instructions For 2021 Form Ri 1040

Where S My Rhode Island State Tax Refund Taxact Blog

Rhode Island Income Tax Brackets 2020

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Rhode Island Sales Tax Small Business Guide Truic

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Historical Rhode Island Tax Policy Information Ballotpedia

List Of States By Income Tax Rate See All 50 Of Them With Interactive Map

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)